Africa’s Investment Outlook 2025: Navigating the Next Wave of Foreign Direct Investment

Foreign direct investment (FDI) has long served as a vital engine of economic growth and development across Africa, with inflows steadily rising over the past decades. Yet, in 2023, the continent saw a 3% decline in FDI, amounting to $53 billion. This dip mirrors global trends, as worldwide FDI also contracted by 2% to $1.3 trillion, largely driven by economic uncertainty and escalating geopolitical tensions.6

Nevertheless, Africa’s long-term investment outlook remains resilient. The adoption of the African Continental Free Trade Area (AfCFTA) Investment Protocol in 2023 marks a significant milestone. By promoting intra-African investment, streamlining regulations, and advancing regional economic integration, the protocol is expected to reignite investor interest and drive a new wave of sustainable, inclusive growth. In this article, we will be exploring the key drivers of foreign direct investment (FDI) across the continent, as well as highlighting the top African countries leading in FDI inflows.

Key Drivers Shaping the Continent’s FDI Landscape

Abundant Natural Resources: Africa is home to vast reserves of oil, natural gas, gold, cobalt, and fertile agricultural land. These resources remain a strong magnet for resource-based investments. Countries such as Nigeria, Angola, and the Democratic Republic of Congo stand out with their long-standing histories of resource-driven FDI, particularly in the extractives and energy sectors.

Expanding Consumer Market: With a youthful, rapidly growing, and increasingly urban population, Africa presents an emerging and dynamic consumer base. This demographic transformation is fueling demand across sectors such as retail, telecommunications, and fintech, making the continent a prime destination for investors targeting growth in consumer-driven markets.

Policy Reforms and Regional Integration: Continental initiatives like the African Continental Free Trade Area (AfCFTA) are paving the way for deeper economic integration and more coherent trade policies. By reducing barriers and harmonizing regulations, AfCFTA is helping to create a more unified and attractive environment for investment across the region.

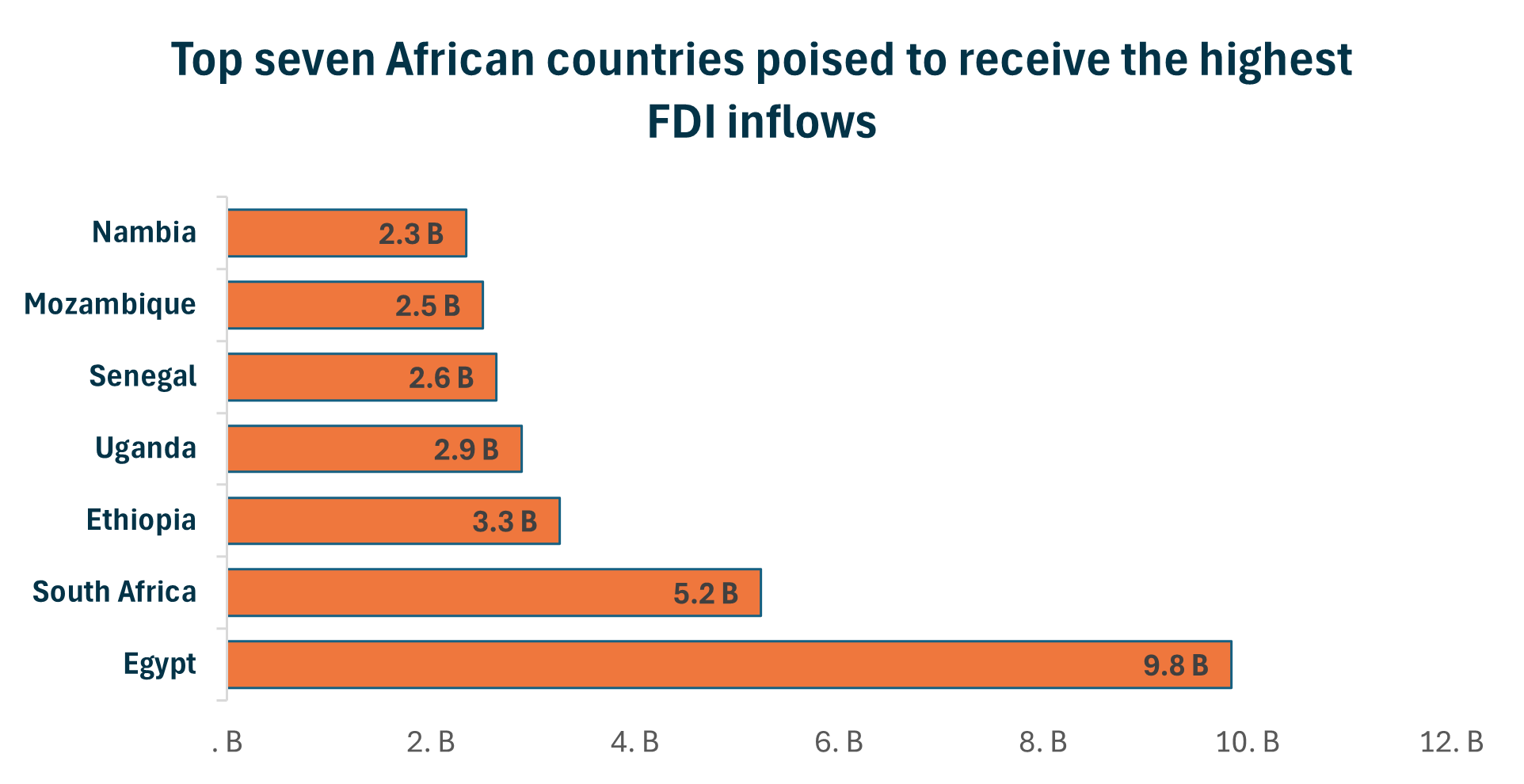

Top 7 African Countries Set to Attract the Most Foreign Direct Investment (FDI) in 2025

Top 7 African Countries Set to Attract the Most Foreign Direct Investment (FDI) in 2025

Egypt: Egypt stands out as a leading destination for foreign direct investment (FDI) in Africa, attracting approximately US$9.8 billion. Its unique position as a transcontinental nation bridging Africa and Asia, along with the critical role of the Suez Canal in global trade routes, makes it a strategic hub for investors.In recent years, the Egyptian government has undertaken significant economic reforms aimed at enhancing the business climate. These efforts include modernizing infrastructure, creating special economic and free zones, and offering targeted incentives to attract investment across diverse sectors. Combined with its diversified economy, these reforms have strengthened Egypt’s reputation as a stable and attractive market for global capital.

South Africa: South Africa remains a top destination for foreign direct investment in Africa, drawing in approximately US$5.2 billion. As one of the continent’s most developed economies, it boasts a well-diversified economic base, world-class infrastructure, and a robust legal and regulatory framework. Its membership in BRICS and participation in regional trade agreements enhance its access to broader African markets, strengthening its role as a regional investment hub.Rich in mineral resources and home to one of Africa’s most sophisticated financial sectors, South Africa continues to attract global investors. Recent government initiatives aimed at streamlining business processes, reducing regulatory burdens, and promoting industrialization have further increased investor confidence and FDI inflows.

Ethiopia: Ethiopia is rapidly emerging as a key FDI destination, attracting approximately US$3.3 billion in foreign investment. With a large and growing population, the country offers both a sizable labor force and an expanding consumer market. The government’s commitment to industrialization—evident in its development of dedicated industrial parks—and major investments in infrastructure such as railways and energy have significantly boosted its investment appeal. Recent economic liberalization reforms, including the opening of previously closed sectors to foreign participation, have further enhanced investor confidence. Ethiopia’s sustained economic growth and strategic development focus position it as one of Africa’s most promising markets for long-term investment.

Uganda: Uganda is becoming an increasingly attractive destination for foreign direct investment, drawing in approximately US$2.9 billion. Recent oil discoveries have significantly boosted investor interest, positioning the country as a future oil and gas hub in the region. Coupled with political stability, a liberalized economy, and a strategic location in East Africa, Uganda offers a conducive environment for sustainable investment. Major infrastructure projects—especially in the energy and transport sectors—have supported this momentum, while growth in telecommunications further diversifies the investment landscape. These developments are not only enhancing the country’s economic prospects but also generating employment and stimulating broader economic activity.

Senegal: Senegal continues to attract strong foreign direct investment, recording approximately US$2.6 billion in inflows. Its political stability, strategic Atlantic coastline, and membership in the West African Economic and Monetary Union (WAEMU) enhance its appeal as a gateway to regional markets. The government’s proactive approach—prioritizing infrastructure, mining, and energy development—has made Senegal a standout investment destination in West Africa. With ongoing reforms and large-scale projects under initiatives like the Emerging Senegal Plan, the country is steadily building a reputation as a reliable and forward-looking hub for international investors.

Mozambique: Mozambique is rapidly positioning itself as a key player in Africa’s energy landscape, drawing in approximately US$2.5 billion in foreign direct investment. The country’s vast natural gas reserves, particularly offshore, have been a major magnet for international investors. Its strategic location along the Indian Ocean also enhances its value as a gateway for regional and global trade. In recent years, government efforts to stabilize the political climate and improve regulatory frameworks have further bolstered investor confidence. With major energy projects underway and a focus on creating a more business-friendly environment, Mozambique is poised for continued investment growth.

Namibia: Namibia continues to attract foreign direct investment, with inflows reaching US$2.3 billion. Its stable political environment, abundant mineral resources, and strategic location along the Atlantic coast make it an appealing choice for investors. The government’s ongoing commitment to infrastructure development and renewable energy projects has further strengthened Namibia's position as a key investment hub. Additionally, efforts to diversify the economy, including the promotion of sustainable tourism and growth initiatives, are expected to bolster Namibia’s attractiveness to long-term investors.

Despite recent challenges, Africa’s long-term investment outlook remains strong, driven by its vast natural resources, expanding consumer market, and ongoing policy reforms like the African Continental Free Trade Area (AfCFTA). Countries such as Egypt, South Africa, Ethiopia, and Uganda are leading the charge in attracting foreign direct investment, fueled by strategic positioning, infrastructure development, and government efforts to enhance business climates. As the continent continues to integrate economically and foster sustainable growth, Africa remains an attractive destination for investors seeking long-term opportunities in diverse sectors, positioning itself as a key player in the global economic landscape.

.png?width=525&height=300&name=Oxano%20Posts%20(58).png)